Press Release: PropertyGuru – Gradual Property Market Recovery Expected in 2022, Positive Outlook Driven By Sustained Demand And Positive Transaction Prices

- Overall median price for transacted properties in H1 2021 recorded an upward trend of 8.5%, the highest rise registered since H1 2016

- Property activity continued to transpire on the back of greater embrace of digital transformation by property companies

- Progressive policies, improved economic environment, and mega projects among key trends that will impact the Malaysian property sector in 2022

Kuala Lumpur, 8 December 2021 – The Malaysian property market looks to be stabilising and is expected to observe a gradual recovery in the first half of 2022, according to PropertyGuru Malaysia’s Property Market Outlook Report 2022. This is in line with a general improved outlook for the Malaysian economy, which is anticipated to perform better next year.

The improved outlook is reflected in the recent PropertyGuru Malaysia Property Asking Price Index, which found that prices were back on an upward trend in Q3 2021, indicating that sentiments are improving in tandem with higher vaccination rates, the reopening of commercial activity, and a less restricted environment for consumers.

“As a rebound in the property sector is expected to trail behind more substantial national economic recovery, we will likely see gradual improvements in the market environment in the first half of the coming year, before it begins to pick up the pace in H2 2022,” said Sheldon Fernandez, Country Manager, PropertyGuru Malaysia.

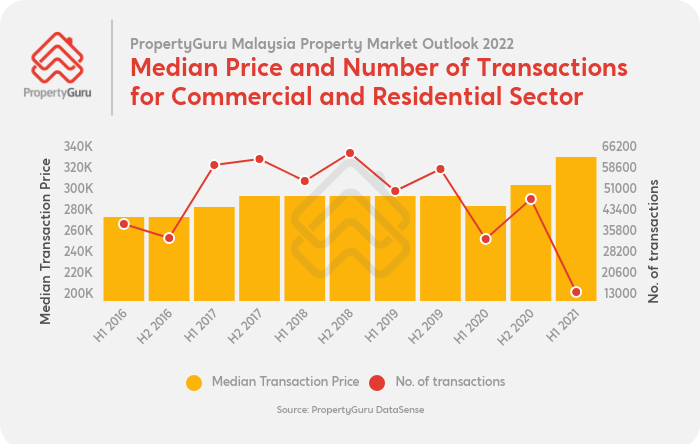

H1 2021: Decline in number of transactions, but rise in median transacted prices

Research by PropertyGuru DataSense, the data analytics and solutions arm of PropertyGuru, found that property activity continued to transpire in Malaysia despite a very challenging environment, albeit at a much-reduced volume.

While the overall number of purchases dropped sharply during the H2 2020 to H1 2021 period, the overall median price for transacted properties actually moved upwards by 8.5% – the sharpest rise registered since H1 2016. The fact that median prices continued to rise while transaction volume dropped sharply indicated that buyers who purchased property during this period had solid financial footing and an appetite for higher-priced properties.

“The combination of low interest rates, depressed property prices, and an incentive-rich environment provided an opportune moment for buyers with the right means to jump into the market. Even at the height of restrictions, their ability to act on purchase decisions were aided by a greater embrace of digital transformation by property companies, which now enables an end-to-end purchasing process for consumers,” said Sheldon.

H1 2022: Opportune time to purchase property, but less ideal climate for sellers

PropertyGuru opined that it is a favourable timing for home seekers who are looking to take advantage of low prices while they are on an upward trend and benefit from prevailing low interest rates while they last. However, they are advised to consider the stability of their personal finances and job security before making a long-term financial commitment.

Sheldon added, “With prices trending in a positive direction in the final quarter of the year, and sentiments gradually, but steadily improving, it is highly likely more property purchasers will want to catch the potential upswing of market prices while the financial environment remains favourable. This is a momentum that is expected to pick up pace and spill over into 2022,” said Sheldon.

PropertyGuru also opined that the current climate is not ideal for those seeking to sell their property for a bigger profit, as sellers are facing competition from a glut of new and unoccupied properties which provided buyers with diverse options. However, should the market pick up pace by mid-2022, properties located in high-valued and centralised locales could see promising upticks in offer prices.

Property market trends in Malaysia for 2022

Moving forward, PropertyGuru foresees several trends that will impact the Malaysian property sector in 2022. Among them include:

- Stabilised market will revive buyer interest: Over the last two years, COVID-19 had influenced buyer behaviour and trends. With vaccination rates increasing, PropertyGuru expects consumer sentiment to gradually improve alongside an improved outlook on job security as the nation continues to recover. Positive price indicators captured in H2 2021 foresees a more stabilised market in the first quarter of 2022, despite issues surrounding pricing mismatch experienced by the property sector prior to the onset of the pandemic.

- Improved economic environment for property seekers: As businesses begin to reopen at full capacity in accordance with the National Recovery Plan, greater economic stability and improved job security for consumers will be seen in 2022, resulting in a more conducive environment for individuals to revive homeownership plans. The recent Budget 2022 announcement also saw the removal of Real Property Gains Tax (RPGT) on homes that are sold on the sixth year onwards, which will help to liberalise the market for investors and second home buyers.

- Progressive policies for a changing landscape: Following the Budget 2022 announcement, the government plans to invest RM2 billion in guarantees to banks via the Guaranteed Credit Housing Scheme, aimed at assisting those in the gig economy. Additionally, a further allocation of RM1.5 billion would be channelled towards housing programmes such as Rumah Mesra Rakyat and the maintenance of public housing units. This illustrates the beginning of more progressive and inclusive approaches in financing and home ownership.

- Ongoing mega projects to enhance future prospects: As mega projects in the country continue to progress, PropertyGuru foresees that this will generate excitement in the property market and add value to residential, commercial, and retail segments. This includes important infrastructure such as the rollout of the Mass Rapid Transit Line 3, East Coast Rail Link, as well as the Johor Bahru-Singapore Rapid Transit System.

- Terraces remain the top choice: Overall, terrace houses remain the most sought-after property type in the country, representing the largest volume of properties purchased by both first-home buyers and investors in H1 2021, according to research by PropertyGuru DataSense. The preference has been influenced by recent COVID-19 limitations as younger professionals are seeking more space to balance both lifestyle and work needs, especially since working from home is now becoming a long-term option, as reflected in the PropertyGuru Malaysia Consumer Sentiment Study H2 2021.

For further information on big property bets and macro trends that will impact the property sector in the next year, please visit the complete PropertyGuru Property Market Outlook 2022 here.

— End Of Press Release —

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.com FB page to get daily updates about the property market beyond kopiandproperty.com articles. Else, follow me on Twitter here.

Next suggested article: 8th PropertyGuru Asia Property Awards 2021. Who are the winners?