Enjoying EPF’s dividends? Self-contribution is possible yeah.

What’s the return of EPF from 2010 – 2022?

Ever wondered what’s the EPF dividend per year? How about stretching it longer and see how it has been for the past 20 over years? If you guessed that it’s higher than the fixed deposit rate, I think you are right. In fact in recent years, when the FD rates are so low, EPF is like a beacon in a storm. Still shining through to give us decent returns for our hard-earned money / contribution. The below is the average since 2020 – 2022.

“Since 2000, the EPF has averaged a 5.6% dividend rate, and as such 5.35% is in line with the long-term average return.” Source: thesun.my

Can guarantee boh?

Probably the only fixed return we know is that EPF has a guaranteed return of 2.5 percent and this is by law.

“Dividends. The EPF guarantees a minimum 2.5% dividend through approved investments to ensure your savings are secured (Simpanan Konvensional). An Annual Dividend payout is credited based on your savings as at 1 January yearly. Your dividends are calculated based on your daily aggregate balance.” Source: kwsp.gov.my

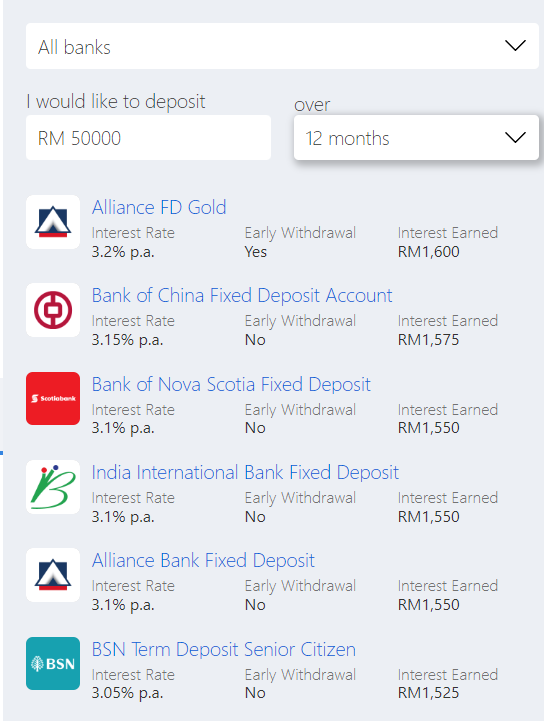

Or the Fixed Deposit rate which is at this moment can be described as paltry. Sigh… Then again, please do not wish for it to be higher because it would meant that the cost of getting a housing loan will also move higher too. Can’t have the cake and eat it too okay? Here are some FD rates. When I was younger, the rate were way higher. 😛

Guaranteed to be lower than inflation too yeah

There were days when the interest rate hovered above the official inflation rate which has always been said to be around 3-3.5 percent. We assume the inflation is still as per the typical rate and we can see that the returns are now below the inflation rate. Actually, beyond just the rate, it also depends on the amount we have in FD versus our spending too.

If we spend RM3,000 per month, that’s RM36,000 per year. If inflation is 3%, then this spending would become RM37,080 next year. If we like to keep up with inflation, then we need to have at least RM36,00 in FD savings in the bank. RM36,000 x 3% FD rate = RM37,080.

If we have less than RM36,000, then our FD return is likely to be lower than the increase in our expenditure, In other words, every passing year meant we become poorer since our earning from the FD cannot even cover the increase in spending due to inflation. We have yet to say what happens when the inflation rate goes up higher…

We can self-contribute an additional RM100,000 every year

This is open to Malaysian and PR only. Sorry, foreigners are not able to enjoy this. The person should also be below 75 years old too. Anyway, if we are 75 already, I think it’s time to spend a bit more and just enjoy. Perhaps the worry at that time is now how much we can save yeah.

The maximum amount we can save for this voluntary contribution per year is RM100,000. So, this year, RM100,000 if you have, next year another RM100,000 if you have. 🙂

This is the page for more information: https://www.kwsp.gov.my/member/savings/self-contribution

The contribution will earn the same dividend as other EPF members too. So, I think this is indeed a great option for members too.

Conclusion

Savings would be the base for investment. Without savings, there is no investment. Without investment, there’s not going to be a bright future too. Savings alone is not enough anymore these days. Perhaps it’s also because there are now so many things we could buy, so many countries we could go and so many food we can taste too. That’s also the reason why we spend more. It’s not just because the younger generation likes to think of You Only Live Once (YOLO). Happy saving.

Thank you for reading! Please do share if you believe others could benefit too. Thank you.

Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER).

Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.com FB page to get daily updates about the property market beyond kopiandproperty.com articles.