When oil prices go up, maybe ask these countries to produce more?

Oil price due to demand and supply equation? (Erm… not exactly)

Okay, demand for oil and the supply for oil is not exactly like that economic theory of demand and supply balancing one another and thus causing the prices to go up and down based on just demand and supply. Demand may go up because people are buying more in anticipation of potential supply shortage. This causes prices to go up until the supply could catch up and then people felt that the supply is going to be too much, then they also stop buying and the prices go down with lesser demand and well, the cycle continues.

These are the world’s largest oil producers. (As per visualcapitalist.com)

United States is a larger producer than even Saudi Arabia…

Middle East remains the largest producers combined because the rest are all individual countries somewhere around the world and not at the same geographic area.

Malaysia is a super small producer of oil. Yet, Petronas is one of the most respected oil companies in the world. I am proud of this fact. Okay, we are still a top producer of another oil; palm oil. 🙂 Which could be turned into diesel if some countries start realising this fact versus trying to protect their own agriculture production. Then again, protectionism is alive and kicking. So, just have to let it be.

Nope, I do not think Electrical Vehicles (EV) will ‘murder’ these oil producing countries. Total EV sales (with super huge support, subsidies and also big marketing) accounts for total of less than 20 percent of total car sales. Just need to note also that I think the ones who would afford them has already bought them and very soon it will come to those who could not afford them. We will see then.

Subsidies would not last forever

The petrol subsidies we enjoy today here in Malaysia could not last forever. Very soon, we will face the reality that buying a car is just the start but buying petrol is really expensive and for many people who could take the public transport, they may really have to take the public transport too. Here are the typical car prices for countries around us. Some are oil producers too…

Indonesia – with the conversion, it’s roughly RM4.30 per litre.

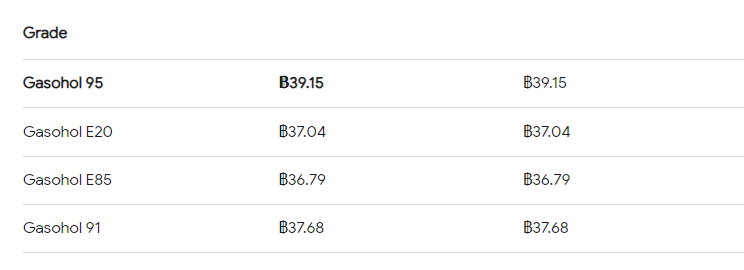

Thailand – Roughly RM5.09 per litre

The Philippines – Roughly RM6.07 per litre

Singapore – No need lah. Only less than 10% of Singaporeans actually own a car. Plus their public transport is super duper top notch. All of them prefer to take them versus driving… (True??!!) If you like to know, roughly RM10 per litre.

Get ready…

If you have fully paid for your car, continue driving it will save you many hundreds of ringgit per month which will easily allow you to pay for the increase in price without the subsidy.

If you have not yet fully paid for the car, then consider using the public transport more often. Some walking is necessary but it’s good for the body anyway. (by the way… that’s how Singaporeans and Hong Kongers are healthier okay… they walk a lot more than us)

If you are thinking of buying a car, your decision is not just the price of the car yeah. The decision is also maybe an extra RM2 per litre kind of decision too. Put that into the calculation too. If your current petrol consumption is RM200 per month, it means it will double to RM400 per month.

Happy understanding and learning about the ‘oil’ world we live in today.

Please do share if you believe others could benefit too. Thank you.

Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER).

Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.com FB page to get daily updates about the property market beyond kopiandproperty.com articles.