Press Release: RM400,000 homes the target of prospective homebuyers

60% of Prospective Homebuyers Target Homes under RM400,000;

Concerns Persist Over Project Delays and Construction Quality

23% of respondents prefer the 1Malaysia Housing Programme (PR1MA) for affordable housing initiatives that meet their aspirations.

59% expressed that rental payments should be factored into their credit score.

74% is more open to utilising the Housing Credit Guarantee Scheme (HCGS) if fixed rate home loans are offered through the scheme.

KUALA LUMPUR, 21 FEBRUARY 2024 — PropertyGuru Malaysia released its biannual Consumer Sentiment Study (CSS) for H1 2024, which revealed that 30% of respondents are looking to purchase a property in the next two years. Among this group, 60% are considering purchasing a home valued at RM400,000 or lower, particularly low-income and younger Malaysians.

Sheldon Fernandez, Country Manager, Malaysia (PropertyGuru.com.my and iProperty.com.my), shared, “The Consumer Sentiment Study (CSS) for H1 2024 highlights the continued strong demand for affordable housing, particularly among low-income earners and young families. However, it is important to note that the PropertyGuru Malaysia Property Market Outlook 2024 showed a quarter-on-quarter decline of 7.4% in the Sale Demand Index in Q4 2023

This suggests that while the intent to purchase is there, the actual conversion may be impacted by various factors such as economic uncertainties and rising interest rates.”

“Our study also shows that 60% of respondents agreed that the increase in the service tax rate, as introduced in Budget 2024, will affect the cost of property purchase. This will lead to buyers becoming more price-sensitive and cautious in their purchase decisions. Moreover, high asking prices has steered buyer interest towards the rental market. The rental trend has sustained strong demand throughout 2023 and is anticipated to increase in the near term. As the market evolves, it is crucial for industry players to understand current consumer preferences and trends. This will enable them to customise their property offerings and contribute to the development of more affordable housing for Malaysians.”

Purchase Challenges: Project Delay and Low Construction Quality are the Top Concerns

Aside from financial concerns, potential homebuyers expressed worries about the delays in projects (65%) and low construction quality (64%) when considering a newly launched property.

This suggests that while the intent to purchase is there, the actual conversion may be impacted by various factors such as economic uncertainties and rising interest rates.”

“Our study also shows that 60% of respondents agreed that the increase in the service tax rate, as introduced in Budget 2024, will affect the cost of property purchase. This will lead to buyers becoming more price-sensitive and cautious in their purchase decisions. Moreover, high asking prices has steered buyer interest towards the rental market. The rental trend has sustained strong demand throughout 2023 and is anticipated to increase in the near term.

As the market evolves, it is crucial for industry players to understand current consumer preferences and trends. This will enable them to customise their property offerings and contribute to the development of more affordable housing for Malaysians.”

Purchase Challenges: Project Delay and Low Construction Quality are the Top Concerns

Aside from financial concerns, potential homebuyers expressed worries about the delays in projects (65%) and low construction quality (64%) when considering a newly launched property.

These concerns highlight the importance of project management and quality control, and the need for developers to address these issues to attract potential buyers.

“According to the Ministry of Housing and Local Government (KPKT), 481 sick projects and 112 abandoned projects has been identified across the country as of June 2023. Therefore, it was not surprising to see that 66% of respondents are calling for better enforcement by the authorities to ensure the highest compliance during the defect liability period (DLP). In a similar vein, 66% expressed the need for the establishment of Developers Guarantee Fund to protect buyers against loss of funds due to bankruptcy or fraudulent activities by developers. These findings underscore the need for stronger policies to safeguard the buyer interest and boost confidence in the property market,” Sheldon added.

Affordability: Housing Programmes Alleviate Homeownership Challenges

When questioned on which housing initiative is perceived as the most useful, the 1Malaysia Housing Programme (PR1MA) is the preferred choice for 23% of respondents, particularly those who are middle-income earners in their 30s. On the other hand, Rumah Selangorku is favoured by 15% of respondents, predominantly those who are married with children. Lastly, the Projek Perumahan Rakyat (PPR) is chosen by 14% of respondents, mainly those from the low-income bracket.

This finding emphasises the need for the government to tailor housing initiatives to meet the preferences of diverse demographic groups. They should also collaborate with financial institutions to offer advantageous loan rates and conditions, and to periodically update policies to address upcoming housing needs.

While these initiatives provide crucial support in realising consumers’ homeownership aspirations, the study sheds light on the challenges individuals face when applying for such schemes. The most common challenge, cited by 46% of respondents, was the difficulty in securing home financing. This indicates that despite the availability of these initiatives, financial constraints due to poor credit history remain a significant barrier for many potential homeowners.

“Among renters or those intending to rent, 59% expressed that rental payments should be factored into their credit score. This could provide an opportunity for potential homeowners to establish a robust credit profile, particularly when it comes to repaying debts. Considering that many young Malaysians might not have liabilities such as hire purchase or student loans, their credit histories could be viewed as limited. This initiative could help them enrich their financial profiles,” Sheldon added.

Meanwhile, 74% respondents are encouraged to utilise the Housing Credit Guarantee Scheme (HCGS) if fixed rate home loans are offered through the scheme. This suggests the need for the government to further refine existing housing incentives to be effectively leveraged by aspiring homeowners. In addition, 66% of respondents would be more likely to apply for the HCGS if the application process is simplified and involves banks or financial institutions (64%). This finding highlights the importance of ease of use and accessibility in promoting the uptake of housing initiatives.

Cost-effectiveness: Respondents’ Preference in Property Features

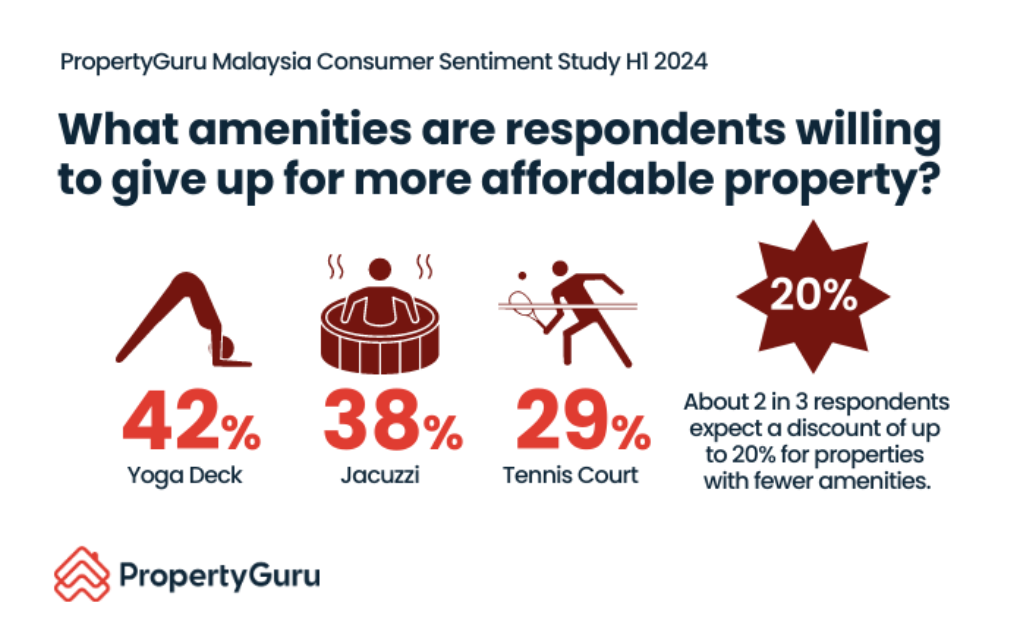

To bring down the selling price of residential properties, 37% of low-income respondents and 40% from middle-income households are willing to forgo certain amenities. These include a yoga deck (42%), jacuzzi (38%), tennis court (29%), swimming pool (24%), gym and designated parking lot (23%). This finding reflects a shift in consumer preferences toward a value-oriented rationale, which emphasise essential property features while staying within budget constraints.

Meanwhile, 62% of respondents, more so among the middle-income, believe that homes with green features will help reduce properties’ operational costs in the long run.

Rental: A Shift in Housing Preference

50% of those intending to purchase a home after one year or those with no purchasing intent, have plans to rent in the future. This is especially predominant among younger Malaysians. Among those intending to rent, 69% allocate a monthly rental budget of RM1,500 or lower. Meanwhile, more than 90% of existing renters are paying the same amount and 35% low- income earners paying less than RM500 per month. It is essential for the government to recognize that even renters or individuals who are not considering purchasing a home face challenges in finding accommodation within their budget.

Meanwhile, 29% of existing renters are considering continuing their tenure for up to two years before buying a home. This is due to various factors such as insufficient savings for property acquisition (74%), a rise in property prices (33%), and no immediate need to purchase properties (29%). The study also highlighted that among existing renters and those looking to rent, 48% feels that the 2+1 deposit requirement is a financial burden, while 45% have difficulty negotiating fair rental prices. This calls for policy interventions that address these challenges to make the rental market more accessible and transparent for potential tenants.

When it comes to regulatory expectations surrounding the rental market, 53% of all respondents support the government’s inclusion of the Rent-To-Own scheme in the Mid-Term Review of the 12th Malaysia Plan. This scheme allows renters to build equity over time and eventually own a property for those who are unable to afford the upfront costs of buying a property. Digging deeper into the reasons for this agreement, 36% cited the inability to save for a downpayment as a key factor. This scheme might help promote affordable rental options that cater to renters’ financial needs while allowing them to gradually transition into homeownership in the future.

“Based on the study’s findings, it is clear that both the government and developers have pivotal roles to play in catering to the evolving demands of property consumers in Malaysia. The significant demand for properties valued at RM400,000 or lower underscores the need for developers to focus on creating more affordable housing options, potentially supported by government incentives.

Additionally, the government should reassess current affordable housing schemes to enhance their effectiveness and ensure they are more appealing and accessible, thereby encouraging more potential homeowners to apply. With sustainability becoming a key factor in purchasing decisions, developers are encouraged to incorporate more green features in their projects, possibly incentivised through government tax benefits or other initiatives. These insights should provide a roadmap for shaping a more inclusive and sustainable property market in Malaysia,” concluded Sheldon.

— end of press release —

Please do share if you believe others could benefit too. Thank you.

Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER).

Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.com FB page to get daily updates about the property market beyond kopiandproperty.com articles.