Property Investment 101: When there’s a crisis, home prices will drop

What will happen to home prices when there’s a financial crisis?

When a home owner is worried about potential financial crisis, he is just worried. He does not suddenly decide to sell his property at a super huge discount unless of course the financial crisis has affected his financial standing. For example, loss of income or even a sudden need for cash. This is why not every property is up for sale even during a financial crisis. The good areas, with stable owners, we will find a couple of units up for sale and for these, it’s usually snapped up pretty quickly by people not affected by the financial crisis.

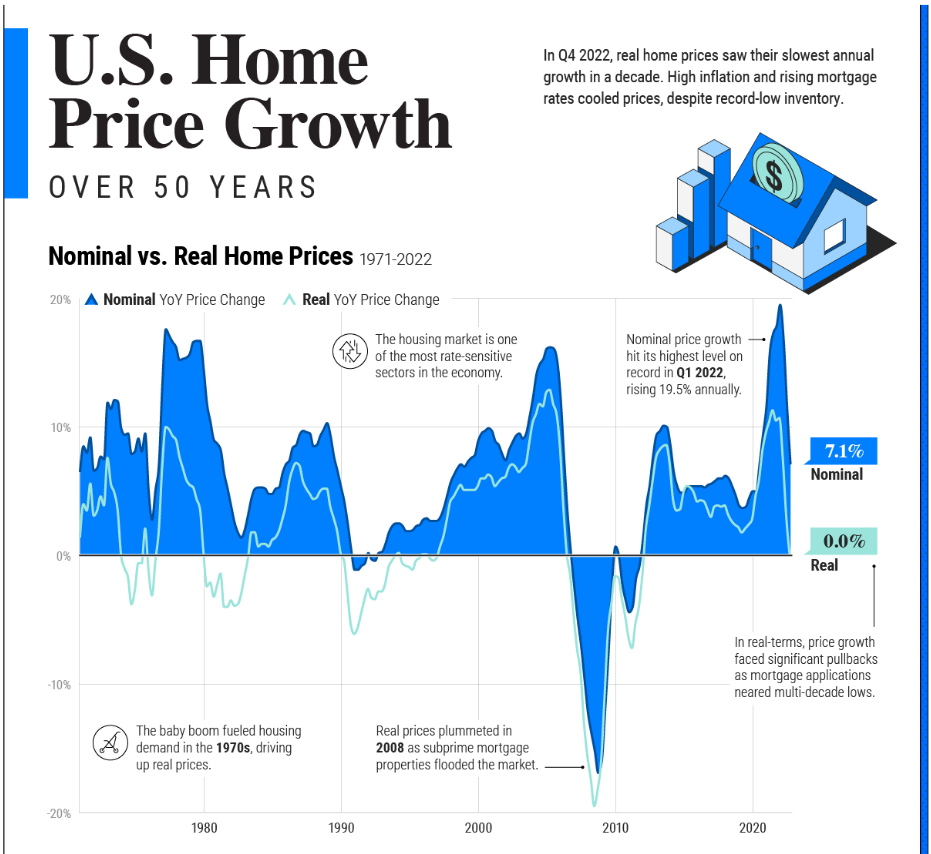

Take a look at what happened in 2008 mortgage crisis (no prizes for guessing which country caused this). Chart from visualcapitalist.com. Just need to look at the never ending rise year after year from the 1990s until that mortgage crisis. Please remember, there’s no such thing as there’s no limit to price increase. Then, it was negative from 2008 to probably 2011 / 2012. The home price rise has then be pretty stable versus the trend in the 90s. HOWEVER, it has now risen higher than just before the 2008 mortgage crisis yeah. I have no idea about what happens next. Your guess is as good as mine.

Meanwhile, pre-crisis (this time it’s Covid) versus post-Covid, this is the current number. Briefly, median home prices have risen by around 42 percent within 3 years.

Property Investment must not be a gamble yeah

What about the situation in Malaysia then? Actually, prices did drop during the crisis yeah. Take a closer look. Look for the 0.00% line. That’s the line showing positive or negative price growth every year. It’s very clear that it was WAY BELOW ZERO in the 1997 / 1998 ASEAN Financial Crisis. Double digits even. Ever since then,it did see some higher than usual growth during the 2011 – 2013 period but after that, things have gotten quiet. Growing, yes but at a steady pace yeah.

Are you waiting for a crisis? Or are you just waiting for it to slowly rise?

A good friend in Penang told me when I was buying my 3rd property that very soon the crisis will come as house prices would become too high and unsustainable. He’s still staying at his same home. His salary is already in the T20 bracket a long time ago, so he will be just fine with or without any investments as long as he does not spend it all. He drives a typical car below RM100k despite being able to drive one twice the price or more. If you are also like him and you have the same thoughts, that’s perfectly fine!

If you have the same thoughts as him but does not earn his kind of income, start thinking about investments yeah. Crisis or no crisis, property or non-property, investments are the only way to grow our money faster than every month (salary) or every year (Fixed Deposit). Happy deciding. Just don’t wait too long and spend it all on cars… holidays… phones… and vacations too.

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.com FB page to get daily updates about the property market beyond kopiandproperty.com articles. Else, follow me on Twitter here.

Next suggested article: When rates rise, property transactions drop, right?