Property Investment 101: If my salary is just RM5,000 per month, can I afford a property today?

Property price vs salary is always a good benchmark

When someone earns RM5,000 he / she can only buy a property of a certain price range. How much can he / she afford? Well, I think we assume he / she will only invest 33% of his RM5,000 pay on monthly home loan repayment. In other words, this is RM5,000 x 33% = RM1,650. Using the mortgage calculator from calculator.com.my and using a 10% down-payment, loan period of 30 years and interest rate of 4.5%. Do refer below.

I could not afford because property prices area already too high

Some latest property listings from propertyguru.com.my Just need to note that it may not totally meet every expectations of someone with a budget of below RM400,000 today.

Be aware of future trends when it comes to salary price and also salary

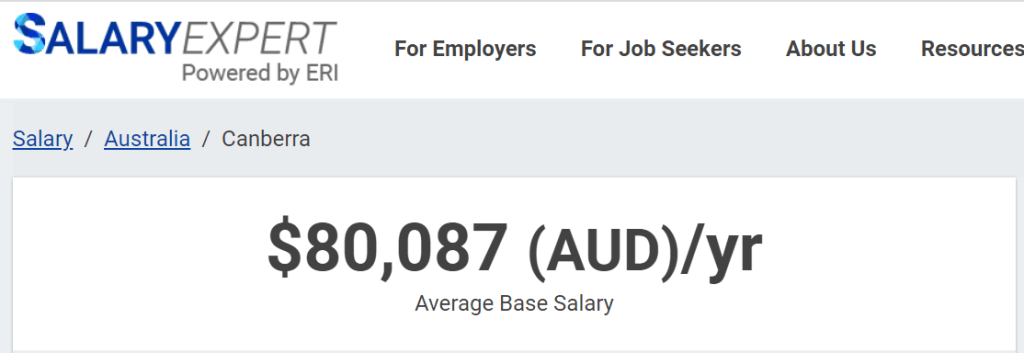

In some markets, we have the following information when it comes to property price (right below) and salary (right after). You can see that the property price in Sydney / Melbourne or even Canberra already at over AUD1,000,000. In other words, the working professionals in these cities must be earning much higher salaries in order to be able to afford a property of their own. Look at the chart after this for the typical salaries for reference.

If my salary is just RM5,000 per month, can I afford a property today?

The answer is with you yeah. Everyone has different priorities and thinking. When I bought my first property, my salary was lower but so was the property prices too. Meanwhile there are those who knows of other investments and prefers to skip property investment, that’s valid too. It’s not whether property investment is good or not good. It’s whether we are investing to have higher returns or we are spending away our money and at the end of the day has no money to invest. This is the right question which we should answer. Happy deciding.

Happy reading!Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER).

Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.com FB page to get daily updates about the property market beyond kopiandproperty.com articles.