Financial news: EcoWorld net profit dropped in Q1

Developer’s profit or loss is also a sign of the market health

Imagine everyone telling you that the property market is going to make a comeback. Then you went to take a look at all the public listed property companies and realises that every company you researched are all suffering from losses. This gives us a very good sign that all is not well with the property market even if many people were telling us otherwise. This is one reason why we should always take note of the financial reporting from property developers. It would be better if many of them if not majority of them are reporting profits. Here’s another one even if the overall number seems to be dropping.

Article in themalaysianreserve.com ECO World Development Group Bhd’s (EcoWorld) net profit dropped by 10% to RM57 million in the first quarter ended Jan 31, 2023 (1Q23) from RM63.36 million a year ago.

The property group told the stock exchange today that revenue for the quarter fell 9.1% to RM484.7 million from RM533.4 million a year ago, due to lower contributions from several parcels, which were substantially completed in the financial year 2022 (FY22).

Revenue was also affected by the earlier Chinese New Year celebrations in January 2023, which slowed down work progress during the festive season. This, it said, is expected to normalise and pick up in the upcoming quarters.

In the first four months of FY23, EcoWorld recorded RM1.35 billion in sales, which was more than the RM1.28 billion achieved in the same period of FY22. This represented 38.5% of the group’s FY23 sales target of RM3.5 billion. Please do read the full article here. Article in themalaysianreserve.com

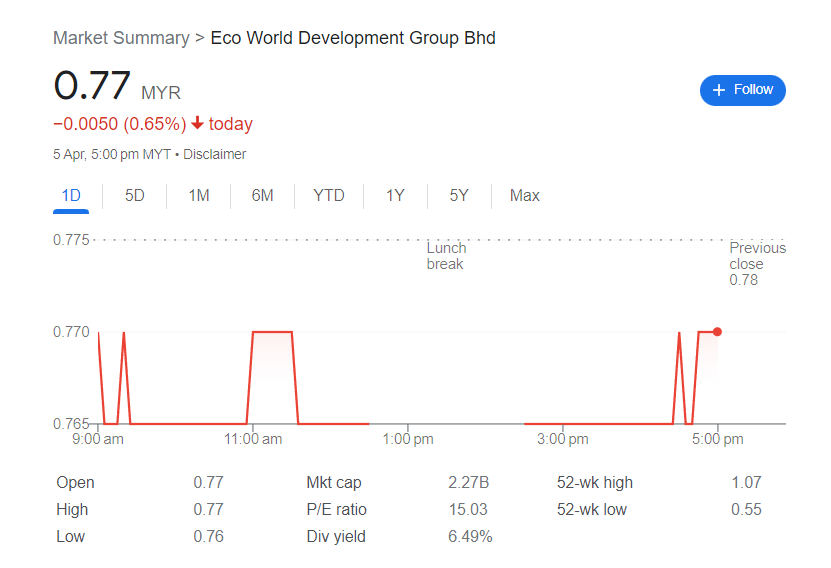

How is the share doing for EcoWorld?

We only need to ask google and it will tell us. Do refer to the image below. If EcoWorld could sustain the dividend yield, then buying into the company at the current price meant that there is a potential dividend yield of 6.49 percent. This is considered healthy yeah. Plus the fact that should it report better results in the quarters to come, chances are the price would also inch upwards too. I do not own shared in this company and will not be buying any for now.

Happy following all other news yeah

Property News Malaysia? Sign up for daily investment news updates (FREE since Nov 2013 and FOREVER). Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.com FB page to get daily updates about the property market beyond kopiandproperty.com articles. Else, follow me on Twitter here.

Next suggested article: When rates rise, buying falls, financial logic right?