When demand increases, rent increases too. Sometimes, we think too much. We look at the property price, seems expensive. Then again, we got attracted because the property developer was giving cashback. The amount was also significant.

Enough to buy many things we had wanted to buy but did not have the money to do so. So, buying the property technically meant one gets a property and also money to buy things one wanted.

Isn’t it a good deal? Actually, I do not know for sure because it really depends on the property itself but I know that using rental is a better gauge.

How do you calculate rental yield? There are many ways but the easiest general guide is whether the rental amount can cover the repayment amount. Note though that on many occasions, repayment higher than rental does not mean it’s not worth buying yeah.

Use the rental to gauge if the property price is indeed way to expensive and that it made sense only after deducting the cashback. If that is the case, then there is no different with buying a cheaper property instead, just that for this cheaper property you are not getting any cashback from the developer which was actually your money anyway.

Now’s let’s look at what happens when demand moves up and supply cannot suddenly follow

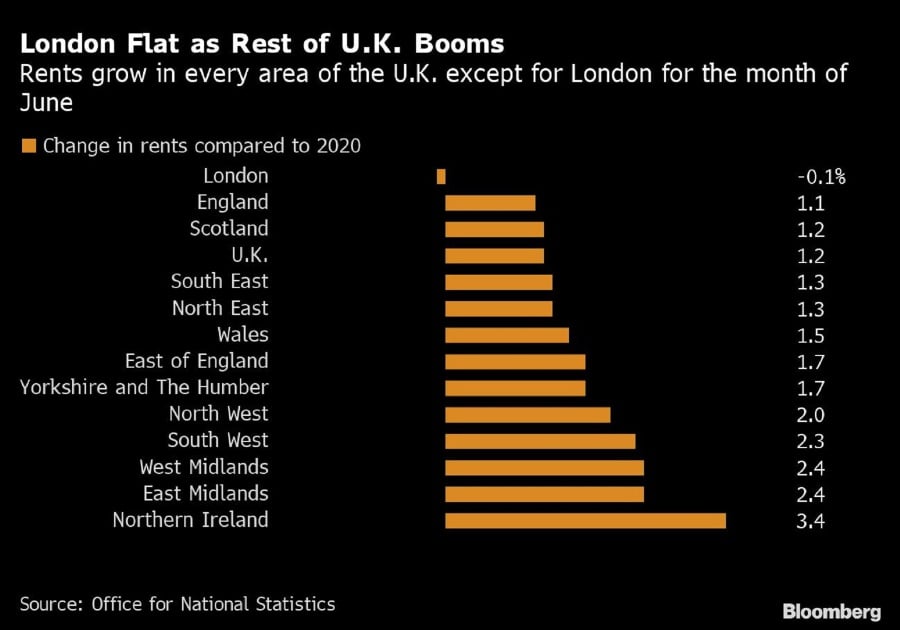

Article in nst.com.my Image belowshows that London was the only region which did not show any rental value increase. London rental values for private homes fell in June as demand for property moved outside cities. Nationwide, the cost of letting a home rose 1.2 per cent from a year ago, a rate unchanged since April.

Please do read the full article with a lot more details on how demand was shifting to further away from city centre as workers could work from home instead. Article in nst.com.my

Moving away from city centre due to work from home is not a permanent reason

I am very sure I am only one of the few who kept telling everyone that there’s no such thing as working from home forever. Here are some recent news: Some signs why office demand new norm is back to norm. So, if I am right, the the rental value dip in London should be temporary until businesses restart their engines strongly.

I am serious yeah. Communication is always super important and that cannot be achieved by just zoom, zoom and zoom. Your customer may be lost if you refuse to meet them once the pandemic is over and they receive a visit from your competitor who gave them a good handshake and have a cup of coffee after their discussion.

It’s not just that yeah, are you going to meet your customers at your home? Or you think it should be at their office? If it is at their office, then they do need an office… right? If the deal is a few million ringgit, you want to sign it at your living hall? Or the lobby of your apartment, where the guard is seated? If the answer is yes, then great. Please proceed. I am very sure many customers are okay to meet you at your home and sign deals at your home…

What about meeting fellow workers? At their home or at your home? Or at the boss’ home? Are there enough car parking space? So, is work still work or is it now leisure. If you let people use your home, do you charge back the electricity to the company? If no, then should you just switch on only the fan but no the air-conditioner and everyone sweating in your living hall as you present the quarterly report? I wonder if you allow them to take a shower after that.

Yea, just an imagination I am sure because work from home can also work from cafe… right? Haha.

Take care and stay safe.

Love news like this and more? Sign up for daily investment news updates. Alternatively, Follow me on Telegram here.

Please LIKE kopiandproperty.com FB page to get daily updates about the property market beyond kopiandproperty.com articles. Else, follow me on Twitter here.

Sign up for KopiWeekly. (only once per week of property, finance, investment news and more)

Next suggested article: Accept LOWer returns? Maybe, for some cases